Modern Healthcare report on the squeeze in hospital operating margins (June 23, 2014)

Operating margin is the easiest way to determine a company’s pricing strategy and operating efficiency. It is the simplest way to understand how much a company makes on each dollar of sales. For non-profit hospitals, a positive operating margin means that there is money available to fund additional services; with

for-profit hospitals, it allows for reinvestment as well as providing for the ability to return to stockholders in the form of a dividend a portion of their investment.

Operating profit margins can be improved by either increasing the revenue received, or decreasing costs, or both. For hospitals, the ability to increase revenues received is limited, and, in fact, is contracting.

The June 24, 2014 cover story in Modern Healthcare (Kutscher, 2014) shows that hospitals have seen their average operating margin decrease from 3.6% in 2012 to 3.1% in 2013. 61.3% of organizations in Modern Healthcare’s analysis saw operating margins deteriorate over the previous years. Consistent with Modern Healthcare’s analysis, both Moody’s and Standard and Poor’s also have seen hospital downgrades due mostly to slumping hospital margins (Letourneau, 2014).

On the rate side of revenue, Medicare and Medicaid rates have been impacted by sequestration, coding offsets, value-based purchasing, DSH payment reductions, and other cuts that are estimated to total $122 billion since 2010 (American Hospital Association, 2014). Proposed Medicare Advantage plan reductions will impact hospital reimbursement. Private payors are scrutinizing payment rates for hospitals, as they see competition in their space for insurance premiums in more ways than ever before. Shared savings and Bundled Payment initiatives, as well as ACO requirements, are also decreasing hospital operating revenues.

In addition to rate impacts, at HFMA’s ANI 2014, S&P’s Managing Director Martin Arrick delineated 6 revenue pressures that are creating a negative outlook for not-for-profit hospitals (Letourneau, 2014).

- Declining utilization

- Increased competition

- Pressure of capital and operating budgets

- Observation status

- Defined contribution health benefits

- State budget concerns

Population Health, which many see as the panacea to solve the operating margin crunch, only accounts for about 5% of hospital revenue (Kutscher, 2014). It also requires a massive build out of a support structure.

With payment decreasing, population health revenues not yet kicking in, and the ability to grow services contracting, that leaves one way to go for hospitals to be sustainable: lower costs. Decreasing costs in the service sector is a difficult task as so much of the cost number is labor, and the simple (but not always correct) solution is to eliminate positions. The best way to lower costs is really to reengineer care based on best practices, not on “doing the same thing with less people” which is a sure-fire way to lower quality.

We’ve seen gainsharing as an effective way to align physicians with hospital goals to decrease costs and not impact quality. Stalk and Hout, in Competing Against Time (1990) reference the constraint of time in as a resource in making changes, as well as the need to compete on cost, quality, and responsiveness. Gainsharing works particularly well in this type of situation because of increased time constraints and the need to quickly align incentives with the people who are responsible for using resources to provide care. It accelerates the slow process of diffusing medical innovation by creating incentives for providing low cost, high quality care.

The AMS approach to gainsharing allows hospitals to set targets not based on arbitrarily created cost goals, but on local/regional norms that are severity and case mix adjusted. The result is that physicians seek out from their peers’ strategies to meet high-level performance targets.

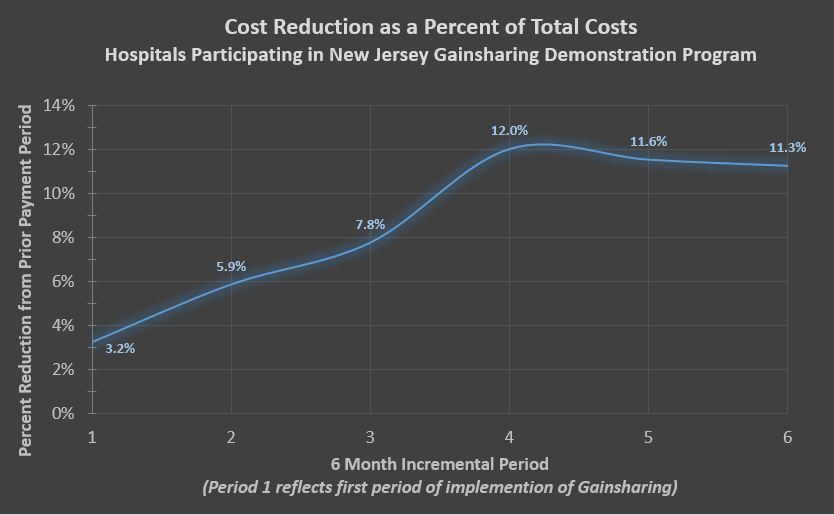

Figure 1 provides an analysis of hospitals that were in the New Jersey Hospital Association Medicare Gainsharing Demonstration Program. On average, hospitals implementing gainsharing were able to see a decrease in costs of 3.2% in the first time period where gainsharing was implemented.

(This is computed by comparing actual cost to expected costs per admission – i.e., base year actual costs adjusted for inflation, case-mix and severity of illness.) However, cost reductions increased significantly at the end of the second year (period 4) as incentive payments and physician participation grew.

(This is computed by comparing actual cost to expected costs per admission – i.e., base year actual costs adjusted for inflation, case-mix and severity of illness.) However, cost reductions increased significantly at the end of the second year (period 4) as incentive payments and physician participation grew.

For these hospitals, gainsharing provides an all-inclusive system of targeted, highly defined financial incentives covering all inpatient cases and costs. It allows hospitals to reallocate valuable resources to building programs for growth, while continuing to provide high quality care to its patients.

References

American Hospital Association. (2014). Hospitals have absorbed nearly $122 billion of new cuts since 2010. Chicago, IL. Retrieved July 2, 2014, from http://www.aha.org/content/14/cumulative-cuts.pdf

Kutscher, B. (2014, June 23). Hospital margins slump due to squeeze from volume, rates, investments. (M. Goozner, Ed.) Modern Healthcare, 44(25), 8, 10.

Letourneau, R. (2014, June 30). 6 Revenue Pressures Create Negative Outlook for NFP Hospitals. Retrieved June 30, 2014, from http://www.healthleadersmedia.com/page-1/FIN-305992/6-Revenue-Pressures-Create-Negative-Outlook-for-NFP-Hospitals

Stalk, G., & Hout, T. (1990). Competing Against Time: How Time-Based Competition is Reshaping Global Markets. New York: Free Press.

Title: Director of Patient Accounts

Organization: Inspira Health Network

Anthony: outstanding article. I absolutely agree with all that you are saying, particularly “the best way to lower costs is really to reengineer care based on best practices, not doing the same thing with less people….” Too many organizations simply do not get this, and they do not get the impact it has on quality of care, and ultimately, on patient satisfaction. Great work Anthony!